Page 18 - EXPORT HYGIENE & BEAUTY

P. 18

ricerche di mercato

market research

Vendita Volume / Purchase Volume

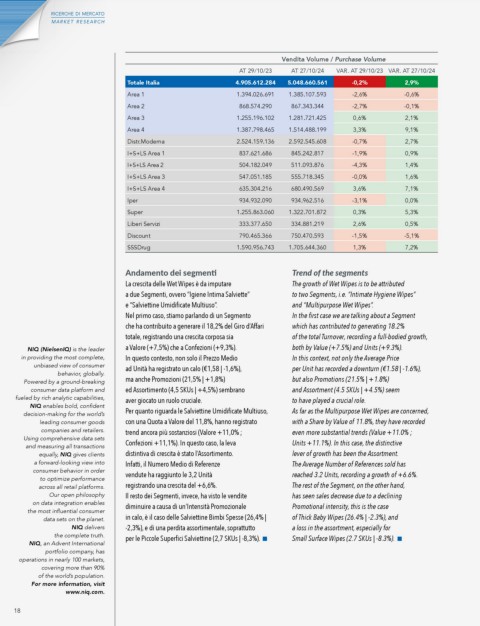

AT 29/10/23 AT 27/10/24 vAr. AT 29/10/23 vAr. AT 27/10/24

Totale Italia 4.905.612.284 5.048.660.561 -0,2% 2,9%

Area 1 1.394.026.691 1.385.107.593 -2,6% -0,6%

Area 2 868.574.290 867.343.344 -2,7% -0,1%

Area 3 1.255.196.102 1.281.721.425 0,6% 2,1%

Area 4 1.387.798.465 1.514.488.199 3,3% 9,1%

Distr.Moderna 2.524.159.136 2.592.545.608 -0,7% 2,7%

I+S+LS Area 1 837.621.686 845.242.817 -1,9% 0,9%

I+S+LS Area 2 504.182.049 511.093.876 -4,3% 1,4%

I+S+LS Area 3 547.051.185 555.718.345 -0,0% 1,6%

I+S+LS Area 4 635.304.216 680.490.569 3,6% 7,1%

Iper 934.932.090 934.962.516 -3,1% 0,0%

Super 1.255.863.060 1.322.701.872 0,3% 5,3%

Liberi Servizi 333.377.650 334.881.219 2,6% 0,5%

Discount 790.465.366 750.470.593 -1,5% -5,1%

SSSDrug 1.590.956.743 1.705.644.360 1,3% 7,2%

Andamento dei segmenti Trend of the segments

La crescita delle Wet Wipes è da imputare The growth of Wet Wipes is to be attributed

a due Segmenti, ovvero “Igiene Intima Salviette” to two Segments, i.e. “Intimate Hygiene Wipes”

e “Salviettine Umidificate Multiuso”. and “Multipurpose Wet Wipes”.

Nel primo caso, stiamo parlando di un Segmento In the first case we are talking about a Segment

che ha contribuito a generare il 18,2% del Giro d’Affari which has contributed to generating 18.2%

totale, registrando una crescita corposa sia of the total Turnover, recording a full-bodied growth,

NIQ (NielsenIQ) is the leader a Valore (+7,5%) che a Confezioni (+9,3%). both by Value (+7.5%) and Units (+9.3%).

in providing the most complete, In questo contesto, non solo il Prezzo Medio In this context, not only the Average Price

unbiased view of consumer ad Unità ha registrato un calo (€1,58 | -1,6%), per Unit has recorded a downturn (€1.58 | -1.6%),

behavior, globally.

Powered by a ground-breaking ma anche Promozioni (21,5% | +1,8%) but also Promotions (21.5% | +1.8%)

consumer data platform and ed Assortimento (4,5 SKUs | +4,5%) sembrano and Assortment (4.5 SKUs | +4.5%) seem

fueled by rich analytic capabilities, aver giocato un ruolo cruciale. to have played a crucial role.

NIQ enables bold, confident

decision-making for the world’s Per quanto riguarda le Salviettine Umidificate Multiuso, As far as the Multipurpose Wet Wipes are concerned,

leading consumer goods con una Quota a Valore del 11,8%, hanno registrato with a Share by Value of 11.8%, they have recorded

companies and retailers. trend ancora più sostanziosi (Valore +11,0% ; even more substantial trends (Value +11.0% ;

Using comprehensive data sets Confezioni +11,1%). In questo caso, la leva Units +11.1%). In this case, the distinctive

and measuring all transactions

equally, NIQ gives clients distintiva di crescita è stato l’Assortimento. lever of growth has been the Assortment.

a forward-looking view into Infatti, il Numero Medio di Referenze The Average Number of References sold has

consumer behavior in order vendute ha raggiunto le 3,2 Unità reached 3.2 Units, recording a growth of +6.6%.

to optimize performance

across all retail platforms. registrando una crescita del +6,6%. The rest of the Segment, on the other hand,

Our open philosophy Il resto dei Segmenti, invece, ha visto le vendite has seen sales decrease due to a declining

on data integration enables diminuire a causa di un’Intensità Promozionale Promotional intensity, this is the case

the most influential consumer

data sets on the planet. in calo, è il caso delle Salviettine Bimbi Spesse (26,4% | of Thick Baby Wipes (26.4% | -2.3%), and

NIQ delivers -2,3%), e di una perdita assortimentale, soprattutto a loss in the assortment, especially for

the complete truth. per le Piccole Superfici Salviettine (2,7 SKUs | -8,3%). Small Surface Wipes (2.7 SKUs | -8.3%).

NIQ, an Advent International

portfolio company, has

operations in nearly 100 markets,

covering more than 90%

of the world’s population.

For more information, visit

www.niq.com.

18